You may have heard that supplemental insurance can help fill financial gaps in major medical coverage, but what does that really mean? Regardless of if you have a High Deductible Health Plan or one with a lower deductible, supplemental health insurance products can give you extra financial protection for expenses that aren’t covered by your major medical plan.

Supplemental Insurance vs. Major Medical Insurance

First, it’s important to understand the difference between supplemental insurance and major medical insurance and how they work together. Supplemental insurance plans are designed to pay benefits directly to the policyholder. Unlike major medical insurance that pays the providers directly for treatment, when you file a supplemental insurance claim, the money is paid to you. Because of this design, you can use the funds however you’d like.

Many supplemental insurance plans pay a benefit to you regardless of what your major medical insurance pays a provider. Other supplemental plans may evaluate what you still owe after your major medical insurance has paid, and then provide a benefit amount to you. Regardless, these plans are designed to help you pay for out-of-pocket expenses, which could include your deductible.

How Supplemental Benefits Are Designed

Some supplemental insurance plans pay a benefit based on the type of treatment you receive. These benefits are typically paid as a flat amount per treatment type. Let’s look at a hypothetical example of an accidental concussion injury. You went to the emergency room for treatment the same day as your injury and were diagnosed with a concussion. You also learned you needed to stay in the hospital1 for observation. For this example, your accident insurance policy may pay you a flat $200 for the concussion treatment, $200 for emergency treatment, and $1200 for Hospital Admission and Confinement.

Alternatively, other supplemental insurance plans pay a benefit based on time spent receiving treatment in a hospital. For example, hospital indemnity insurance may provide up to $1,000 per day (at least 18 hours) spent in a hospital.

Because these insurance policies are independent of your medical insurance and independent of one another, you may receive hospital admission and confinement benefits from both policies. As always, please read your policy for specific limitations and exclusions.

How to Use Supplemental Benefits for Deductibles

For the accidental concussion example, the hospital bill includes an emergency room visit, concussion treatment, and hospitalization.

Hospital Bill Total: $9,592

- Emergency Room Visit Cost: $1,1122

- Hospitalization, 2 days: $8,4803

Supplemental Insurance Benefits Total: $2,700

- Emergency treatment: $1504

- Concussion injury treatment: $2005

- Accident Policy Hospital Admission Benefit (1st day): $1,0006

- Accident Policy Hospital Confinement Benefit (2nd day): $2007

- Hospital Indemnity Policy Hospital Admission Benefit (1st day): $1,0008

- Hospital Indemnity Policy Hospital Confinement Benefit (2nd day): $1509

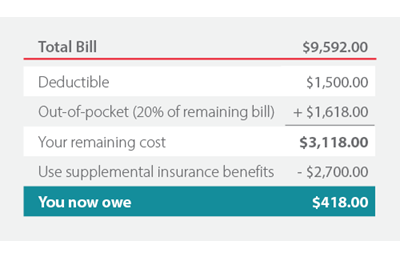

Let’s say that you have a deductible of $1,500, and after that is met, you will pay 20% of costs out-of-pocket. If your total medical bills were $9,592, you would be paying $3,118 total out of pocket including your deductible. With the benefits from your accident insurance and hospital indemnity insurance paying you $2,700, you could use this toward your out-of-pocket expenses, making your remaining amount only $418. That reduces your out-of-pocket costs by more than half!

Even though your major medical insurance paid a significant portion of the bill, the supplemental insurance helped cover your deductible and reduced your remaining out-of-pocket costs. This is why supplemental insurance can be important to your benefits package.

Learn more about supplemental insurance at americanfidelity.com/info.

This blog is up to date as of May 2019 and has not been updated for changes in the law, administration or current events.