Filing insurance claims may feel like a confusing or stressful (or both) process for you and your employees, but it doesn’t have to be.

As part of an ongoing series to address common questions about claim forms, here are some tips and solutions for frequently asked questions we hear from employers and employees regarding the disability claim form.

Question #1: What’s the quickest way to file?

Online! You can file your claim online or through AFmobile®, removing the need for you to complete and submit a paper form. Once the Attending Physician Statement and Employer’s Report of Claim are complete, you can upload them to your claim through your online account.

Question #2: Who should fill out the Employer's Report of Claim?

Not sure who on your team should fill out the Employer’s Report of Claim? The Human Resources, Payroll, or Benefits Departments are usually good choices. Because they have access to employee information, they can ensure accuracy and detail on the form.

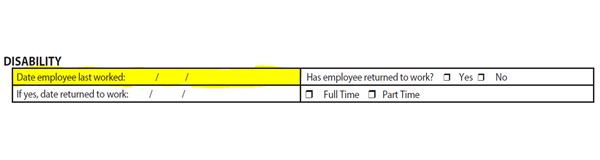

Question #3: What should I put for the data last worked?

We hear from many employers who are unsure of what to write in this section, especially for the “Date employee last worked” field. Particularly, this can cause confusion if the disability happens when the employee is on approved leave (such as bonding with a child, caring for a parent, etc.) or break (like summer or holiday vacation). For clarity, this question should be answered with the day the employee was last at work.

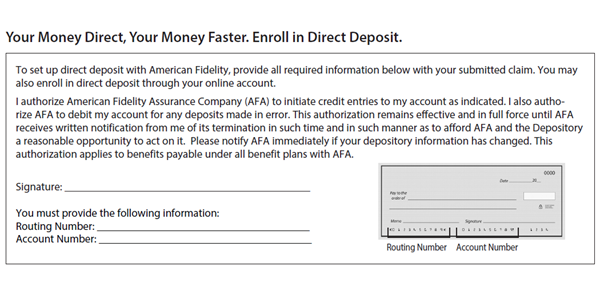

Question #4: What do I need to do to enroll in direct deposit for my benefit?

The first page of the claim form includes a section for direct deposit authorization information, but the easiest way to enroll in direct deposit is through your online account. By adding your bank account information, you can ensure any benefit payment is received via direct deposit.

If you’re signing up for direct deposit via the form, simply ensure all the information in the section below is completed.

Question #5: Do I really need to fill this part out?

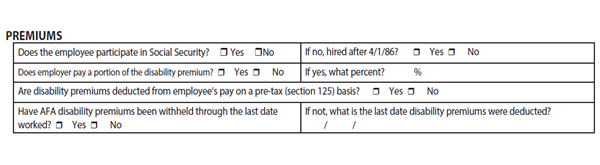

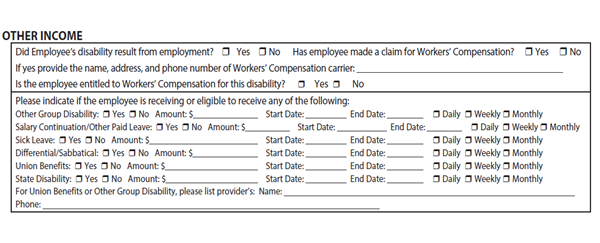

Missing information not only delays processing, but also affects benefit taxability and amount. For example, two sections that are frequently overlooked or incomplete are the Premiums and Other Income sections on the Employer’s Report of Claim.

Premiums:

Other Income:

With a disability claim, each piece of information included on the Employee, Employer, and Physician’s forms contain vital information for claims processing teams. It’s important to complete these sections in full to ensure the most timely claim processing.

These are just a few of the common questions we hear. Employees can find other questions and resources on the disability insurance support page. Your dedicated account manager can always help with questions, too!

This blog is up to date as of September 2019 and has not been updated for changes in the law, administration or current events.