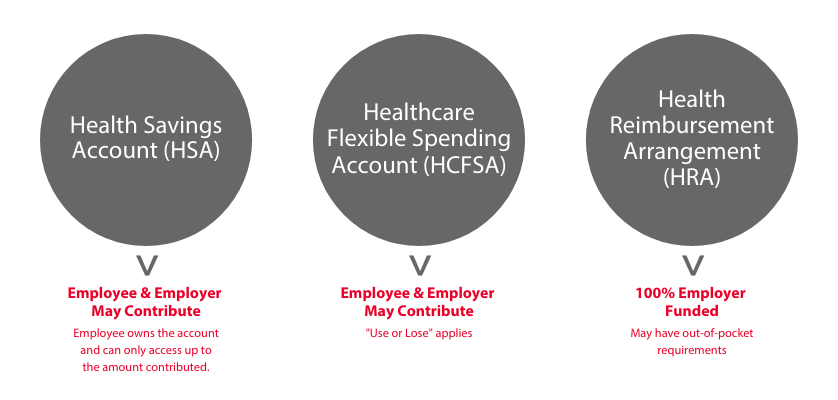

When it comes to reimbursement accounts, the differences can be confusing. Between Healthcare Flexible Spending Accounts (Healthcare FSA), Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs,) how do you know which to offer employees? How do you determine which type pairs best with your health plan offering(s)?

Reimbursement accounts offer tax benefits for both employers and employees and provide a way to pay for eligible medical expenses with money that has been set aside. Here is an example of how an employer saves money by offering reimbursement accounts:

Let’s try to clear up some confusion on the account types and look at which account is most appropriate for sample health plans.

Healthcare Flexible Spending Account

A Healthcare FSA allows employees to save for eligible healthcare costs for the current plan year. Employees and the employer may contribute to or “fund” the account.

What you need to know:

- Full election amount is available first day of the plan year

- Election changes (or adjusting contribution amount) require a qualifying event

- “Use or lose” applies

- Account stays with the employer if the employee terminates employment

- Can be paired with a High Deductible Health Plan (HDHP) or a PPO

- May have a run off period and a rollover or grace period

Health Savings Account

An HSA is an individually owned account that allows employees to save for eligible healthcare costs now, and into the future.Employees and the employer may contribute to or “fund” the account.

What you need to know:

- Must be paired with a qualified HDHP

- Triple tax advantage: money goes in tax-free, savings grow tax-free, and withdrawals are tax-free if used for eligible items

- Account stays with employees, even if they change jobs

- May adjust contribution amount at any time (subject to employer’s plan)

- No “use or lose” rule - save what’s not spent

- Generally, an employee can invest savings for growth, just like a 401(k)

Health Reimbursement Arrangement

An HRA is generally used to help employees pay for eligible healthcare expenses and help offset certain out-of-pocket costs not covered by the employees’ major medical plan. The account is 100% employer funded.

What you need to know:

- Contributions are non-taxable to employees

- May have a rollover and/or run off period

- Does not have to be paired with a qualified HDHP

- Multiple plan design options are available, allowing employers to control the total cost of offering the HRA

Since HRAs are not required to be pre-funded, employers can decide to pre-fund or to pay only when an employee files a claim

Choosing the Best Plan for Your Needs

The good news is, no matter your situation, there is a tax-advantaged reimbursement account that can work for your employees. Understanding your organization’s goals can help you determine the best fit for your business.

Download this chart to help you and your employees understand some of the high-level account differences.

If American Fidelity Assurance Company is your benefits provider and you’d like further education on account types, contact your local account manager. If you don’t currently offer a Section 125 Plan and are interested in getting one set up, contact us. We’re here to help.

Shop the FSA Store

Purchases may result in a small commission to American Fidelity at no additional cost to you.

Shop the HSA Store

Purchases may result in a small commission to American Fidelity at no additional cost to you.

This blog is up to date as of February 2020 and has not been updated for changes in the law, administration or current event.